数字货币是近年来金融科技领域的一大热点。相较于传统的货币形式,数字货币具有便捷、高效的特性,可以大大提高交易效率。随着技术的发展,比特币等加密货币逐渐崭露头角,推动了全球数字货币的快速发展。

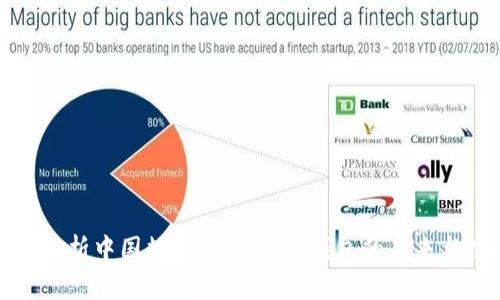

但仅依靠市场机制的加密货币存在着价格波动大、泡沫风险高等问题。因此,各国央行纷纷开始对数字货币进行探索,其中中国央行在2020年正式启动了数字货币的研发,推出了数字货币电子支付(DCEP)。

### 2. DCEP钱包的基本功能DCEP钱包是用户存储和管理数字人民币的一款工具,其基本功能涵盖了转账、收款、消费和余额查询等。用户可以通过手机应用便捷地进行各类金融操作,体现出数字货币的便利性。

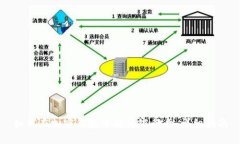

DCEP钱包的工作原理是基于区块链技术,利用密码学手段确保交易的安全性和匿名性。此外,DCEP钱包还支持离线支付功能,不受网络环境限制。

### 3. DCEP钱包的使用场景DCEP钱包的应用场景非常广泛。在商业支付中,商家可以通过DCEP钱包收款,避免了传统银行转账的繁琐流程。在个人财务管理中,用户可以便捷地进行资金管理和账户监控,提升财务透明度。此外,在跨境支付方面,DCEP钱包有助于降低交易成本,加快资金流动速度。

### 4. DCEP钱包的安全性安全性是数字钱包最重要的考虑因素。DCEP钱包采用了多重安全技术,包括数据加密、用户身份验证等,确保用户资金和信息安全。防止黑客攻击与信息泄露的措施也在不断完善,增强用户信任。

### 5. DCEP钱包的未来发展趋势随着政府对数字货币的支持力度加大,DCEP钱包的发展前景十分广阔。未来,DCEP钱包将与传统金融业务深度融合,提升支付效率。同时,新技术的引入也将推动DCEP钱包的不断升级。

### 6. DCEP钱包面临的挑战尽管DCEP钱包具有广泛的应用前景,但也面临着多方面的挑战。首先是技术挑战,如如何确保系统的稳定性和处理高并发交易的能力。其次是用户接受度,如何让大众愿意接受并使用DCEP钱包。此外,隐私保护问题也需要引起重视,确保用户信息不被滥用。

--- ### 什么是DCEP钱包?什么是DCEP钱包?

DCEP钱包是中国央行推出的数字人民币(DCEP)专用数字钱包,用户可以通过它接收、存储和使用数字人民币。DCEP钱包具有多种功能,包括实时支付、余额查询和交易记录管理。

与传统的钱包不同,DCEP钱包基于先进的区块链技术,确保交易的安全性和稳定性。DCEP钱包的设计旨在为用户提供便捷的支付体验,尤其是在移动支付和电子商务日益普及的背景下。

用户只需下载官方推出的DCEP钱包应用,完成实名认证,即可轻松管理他们的数字人民币。这个过程保证了用户的身份和资金安全,同时也符合反洗钱和反恐融资的相关法规。

--- ### DCEP钱包的安全性如何?DCEP钱包的安全性如何?

安全性是DCEP钱包设计中的重要考虑因素。DCEP钱包采取了多重安全措施,包括数据加密、用户身份验证和交易审核等。数据加密技术确保了交易信息在传输过程中的安全性,防止未授权的访问和欺诈。

此外,DCEP钱包采用了生物识别技术(如指纹识别和人脸识别),以增强用户身份验证的安全性。这种技术能够有效阻止他人非法使用用户的账户。

为了防止黑客攻击,DCEP钱包还利用了分布式账本技术。这种技术使得数据并不是集中存储,而是分散在多个节点中,降低了系统被攻击的风险。同时,央行对DCEP钱包的系统进行持续监测,以保障其运行的安全性和稳定性。

--- ### DCEP钱包的使用方便吗?DCEP钱包的使用方便吗?

DCEP钱包的使用相对简单便捷。用户只需下载应用并完成注册,便可以灵活地进行各种金融交易。DCEP钱包界面友好,易于操作,即使是技术水平不高的用户也能轻松上手。

通过DCEP钱包,用户可以在几秒钟内完成转账、收款和消费,极大缩短了交易时间。同时,DCEP钱包还支持离线支付功能,使得用户在没有网络的情况下也能够完成交易,增添了更多的灵活性。

此外,DCEP钱包还与多种实体商户、网上支付平台合作,用户可以在广泛的场景中使用数字人民币,使得日常支付更加简便。未来,DCEP钱包将继续用户体验,以适应不断变化的市场需求。

--- ### DCEP钱包对用户隐私的保护如何?DCEP钱包对用户隐私的保护如何?

User privacy is one of the top concerns regarding digital currency wallets, especially in the age of data breaches and privacy violations. DCEP wallets are designed to safeguard user privacy through encryption technology and regulatory compliance.

Encryption ensures that transaction data is securely transmitted, making it difficult for unauthorized individuals to access sensitive information. Additionally, DCEP wallets are designed to minimize the collection of personal data, thereby protecting user privacy. The Chinese government has implemented regulations governing data protection and privacy standards for digital currency transactions, which further aids in bolstering user trust.

Despite these measures, it’s essential for users to stay informed about potential privacy risks and to adhere to best practices for protecting their personal information, such as avoiding public Wi-Fi when conducting transactions. Ongoing improvements in privacy protection will be crucial for the long-term adoption of DCEP wallets.

--- ### DCEP钱包的未来发展趋势是什么?DCEP钱包的未来发展趋势是什么?

DCEP wallets are poised for significant growth and evolution in the coming years. With government support projected to increase, the integration of DCEP into existing financial systems is expected to enhance overall economic efficiency. DCEP wallets will likely become more ubiquitous, especially as consumer behaviors shift toward digital solutions.

Technological advancements will also play a pivotal role in shaping the future of DCEP wallets. Emerging technologies such as artificial intelligence and machine learning may be incorporated into DCEP wallets to enhance security, fraud detection capabilities, and user experience. Furthermore, partnerships with major payment platforms and financial institutions will help broaden the acceptance and usage of digital currencies.

As user familiarity with digital wallets grows, the potential for diverse applications—ranging from international trade to innovative financial products—will expand. The future landscape of DCEP wallets will depend not only on technological advancements but also on regulatory frameworks and user trust.

--- ### DCEP钱包使用中可能面临哪些挑战?DCEP钱包使用中可能面临哪些挑战?

While DCEP wallets present many advantages, they also face several significant challenges. One of the primary challenges pertains to technological issues. Ensuring that the infrastructure is stable enough to handle large volumes of transactions without downtime is crucial for user satisfaction. The system must also be able to scale effectively as adoption rates increase.

Another challenge relates to user acceptance. For DCEP wallets to thrive, a critical mass of users must be willing to embrace this new technology. Education campaigns and outreach efforts will be essential to inform the public about the benefits and functionality of DCEP wallets, mitigating the fears and misconceptions associated with digital currencies.

Privacy concerns also pose a significant hurdle. Although security measures are in place, users need reassurance that their data will be handled responsibly and ethically. As such, ongoing transparency about how data is used and protected will be crucial for fostering trust among users.

Overall, the successful implementation of DCEP wallets will depend on collaborative efforts between the government, financial institutions, and technology providers to address these hurdles proactively.

--- 这个大纲和内容展示了关于中国数字货币DCEP钱包的多方面分析,可以根据需求延展至3500字及以上。通过深入探讨每个问题,能够为读者提供系统全面的知识,同时提高效果。